Nevertheless, one of the most vital difficulties of possessing a laundromat is obtaining the required resources to find the business up and jogging or to aid it improve. Probably the greatest methods to do this is through a business loan.

LendingTree is compensated by organizations on This web site which payment may impression how and in which features seem on This great site (such as the order). LendingTree will not contain all lenders, price savings solutions, or loan options readily available in the marketplace.

Financial institution of America is dedicated to the protection of private information we obtain and system. For more info about how we secure your privacy, remember to pay a visit to (). California citizens can have added legal rights and you'll learn more at .

Our associates are not able to pay out us to ensure favorable assessments of their products and solutions or products and services. Here is a list of our companions.

Look at the variety of loan or lease you will need and which lender provides you the most effective loan terms. You can commonly uncover small business equipment loans with large loan amounts and extensive or adaptable repayment terms, such as presenting semi-once-a-year or annual payments. When you’re Prepared, Get the needed files and apply for your required equipment loan.

Chart: Expense, earnings, and money stream breakdown of the bottom priced laundromats currently shown available

Regardless of whether you’re planning to finance a manufacturer-new laundromat or buy an existing business, you can find a ton of loan choices in existence. So long as you already know your business and personal credit history scores, Have got a stable grip on the financials, and have a established intent on your loan in mind, yow will discover a borrowing possibility that works best for your personal targets.

Discounted income circulation strategy. This calculation is predicated on projections of the long run income flows of the business, then reductions them to today determined by inflation. It's a complex calculation most effective based on making use of an NPV calculator.

An SBA loan is actually a loan furnished by A personal lender but assured through the U.S. Small Business Administration (SBA). This ensure means that the SBA will cover a percentage of the loan If your borrower defaults. For that reason warranty, lenders are often far more willing to supply favorable phrases and charges to small businesses.

NerdWallet’s evaluation course of action evaluates and rates small-business loan solutions from conventional financial institutions and on line lenders. We gather above 30 info details on Every lender making use of firm Web-sites and community files.

Business conditions, equipment failure and/or technological improvements may render the purchase worthless prior to the how to get a loan for a restaurant loan phrase has finished.

Just because chances are you'll qualify for the significant loan doesn’t necessarily mean you've got plenty of money to pay for it again. Maybe you have a down thirty day period exactly where funds is tight, that makes it challenging or unachievable to produce a payment. Or, alternatively, chances are you'll uncover that your money movement is briefly in problems resulting from an surprising repair service.

Every author and editor follows NerdWallet's rigid tips for editorial integrity to make sure accuracy and fairness inside our protection.

Investigate much more lifestyle insurance resourcesCompare lifestyle insurance coverage ratesBest lifestyle insurance coverage companiesLife insurance coverage reviewsLife insurance quotesLife coverage calculator

Christina Ricci Then & Now!

Christina Ricci Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Dawn Wells Then & Now!

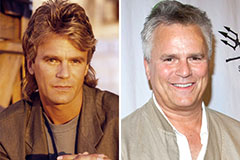

Dawn Wells Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!